As your life changes, so will your car insurance needs. Why? The purpose of car insurance goes beyond repairing damage to your vehicle in an accident. It also covers your liability in cases where you are sued as a result of a car accident. By understanding how car insurance needs may change with age, you can better protect yourself and limit your personal liability.

As your life changes, so will your car insurance needs. Why? The purpose of car insurance goes beyond repairing damage to your vehicle in an accident. It also covers your liability in cases where you are sued as a result of a car accident. By understanding how car insurance needs may change with age, you can better protect yourself and limit your personal liability.

Car Insurance Coverage Limits

Car insurance includes coverage limits under specific categories. For example, there is a limit for bodily injury and for property damage. If you are involved in an accident for which you are at fault and the damages exceed your coverage limits, you may be held personally liable for the difference. This applies no matter what your age.

Why Car Insurance Needs May Change with Age

When you are young, your insurance rates tend to be higher given your lack of driving experience. You also have less income available to pay for your living expenses, including insurance. Therefore, you are likely to select minimal coverage for your car insurance policy in order to receive the lowest premium possible.

As you get older, your years of driving experience will help you obtain a lower premium. Your employment situation should also improve. It is important to consider increasing your coverage limits to better protect yourself. The cost of increased coverage is low considering the added benefit that it can offer.

Evaluating Your Car Insurance Options

Speak to your independent insurance agent about your current insurance coverage and what coverage limits you should consider increasing. Your agent can also help you identify discounts available that may help offset the increased coverage limits. It is a good idea to review your policy regularly and to understand what additional options are available to you.

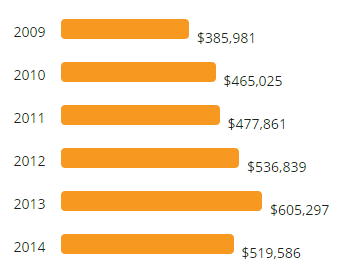

Comparison Of Renting Versus Buying MA Homes

Comparison Of Renting Versus Buying MA Homes